4 Easy Facts About Offshore Wealth Management Described

Wiki Article

The 3-Minute Rule for Offshore Wealth Management

Table of ContentsNot known Details About Offshore Wealth Management Little Known Questions About Offshore Wealth Management.Not known Facts About Offshore Wealth ManagementOffshore Wealth Management Things To Know Before You Get ThisOffshore Wealth Management Fundamentals Explained

If you are wanting to overseas investments to assist protect your assetsor are interested in estate planningit would certainly be sensible to discover a lawyer (or a team of lawyers) concentrating on possession defense, wills, or service succession. You require to check out the financial investments themselves and also their lawful and also tax obligation effects - offshore wealth management.For the most part, the benefits of overseas investing are surpassed by the incredible prices of expert charges, compensations, and traveling expenses.

Jersey is an overseas area with deep-rooted connections to our impact markets. With broad market knowledge in riches monitoring and also economic structuring, Jersey is related to as one of the most developed as well as well-regulated offshore economic centres on the planet.

A Biased View of Offshore Wealth Management

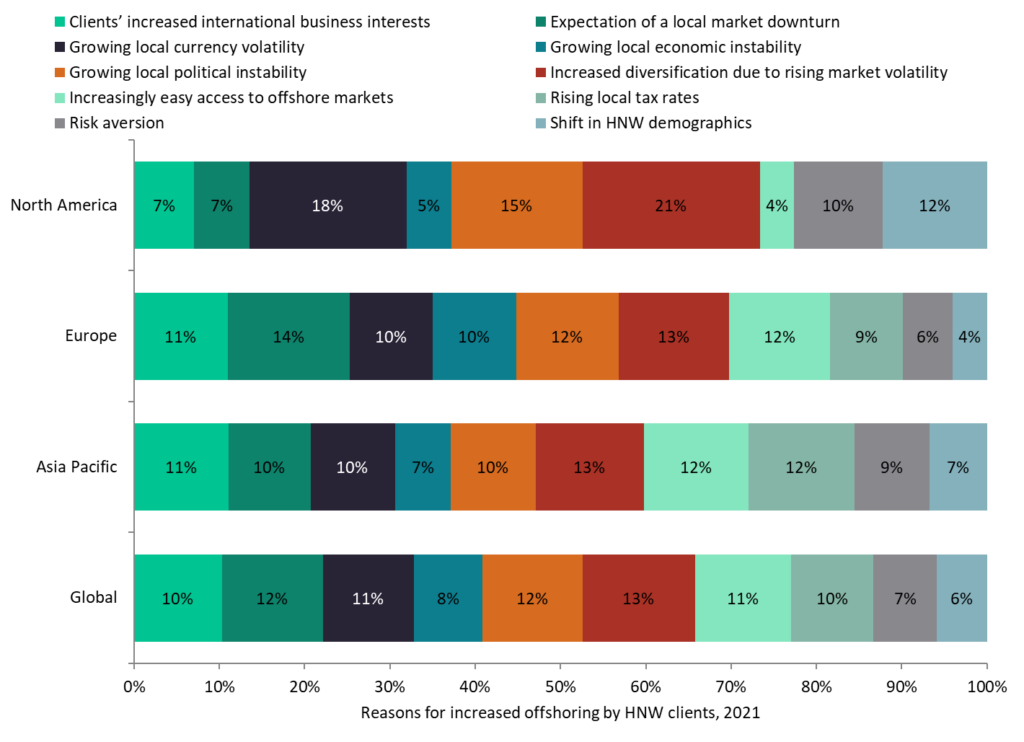

Listing of Figures, Figure 1: Offshore assets surged early in the pandemic as financiers looked for risk-free places beforehand as well as then chose investment chances, Figure 2: The tidal bore of non-resident riches into Europe is declining, Figure 3: The central functions of New York as well as London stay also after wide range drains pipes from somewhere else in the regions, Number 4: Asia-Pacific is once more back to driving development in the offshore market, Figure 5: Adverse macroeconomic 'push' factors are driving the increase in HNW offshore investment, Figure 6: Australian investors that are eager to straight own a stylish tech stock are being targeting by moomoo, Figure 7: Anonymity and tax obligation were largely absent as motorists for offshoring during the pandemic, Number 8: Financial institutions significantly enhanced their hiring for guideline and also conformity in the very early months of 2022Figure 9: Regulation-related work employing from Dec 14, 2021 to March 14, 2022 compared to previous quarter, Figure 10: The North American market is well provisioned with overseas services, Figure 11: Money danger has actually grown over the last ten years and also is heightened in times of dilemma, Figure 12: The majority of personal riches firms in the United States and also Canada can attach customers to overseas companions, Number 13: Citibank's overseas investment alternatives cover numerous asset courses, Figure 14: ESG is simply as important as high returns in markets that Standard Chartered has existence in, Number 15: Criterion Chartered's worldwide service deals with both fluid and also illiquid offshore financial investments, Figure 16: HSBC Premier India solutions focus on international opportunities as well as NRIs (offshore wealth management).There are many, and also the complying with are simply a few examples: -: in several countries, bank down payments do not have the exact same defense as you may have been made use of to in the house. Cyprus, Argentina as well as Greece have actually all offered instances of banking situations. By utilizing an offshore bank, based in a very managed, clear territory with legal securities for capitalists, you can feel safe and secure in the understanding that your cash is risk-free.

A connection manager will certainly always supply a personal factor of get in touch with who need to make the effort to comprehend you and your needs.: as a deportee, having the ability to maintain your Visit Website savings account in one place, despite the number of times you move countries, is a major benefit. You also know, no issue where you are in the world, you will have accessibility to your cash.

The 2-Minute Rule for Offshore Wealth Management

These range from keeping your money outside the tax obligation net of your residence country, to protecting it from tax obligations in the country you're presently staying in. It can additionally work when it pertains to estate preparation as, depending upon your nationality and also tax standing, possessions that rest in your offshore savings account may not undergo estate tax.

Investing via an offshore financial institution is uncomplicated and there is generally guidance or tools handy to help you produce a financial investment profile ideal to your risk profile and the results you intend to achieve. Attaching an offshore financial institution account is normally a lot more flexible and also transparent than the alternatives that are traditionally used.

You can capitalize on these benefits by opening an overseas savings account. It is a basic as well as quick process. Some financial advisory companies, like AES International, can open an overseas exclusive savings account for you within 2 days, provided that all the needs are satisfied.

The Basic Principles Of Offshore Wealth Management

Before you spend, make certain you really feel comfy with the level of risk you take. Investments objective to grow your cash, yet they might shed it too.This is being driven by a solid determination to relocate towards refinement, based upon an acceptance of foreign experience in terms of items, services and also procedures. In India, at the same time, the huge quantity of brand-new wealth being produced is productive ground for the appropriate offering. According to these and also other local patterns, the interpretation as well as extent of exclusive banking is transforming in a number of these neighborhood markets in addition to it the demand to have access to a bigger variety of product or services - offshore wealth management.

Offshore Wealth Management Fundamentals Explained

International players require to take note of some of the obstacles their counterparts have actually faced in particular markets, for example India. The bulk of worldwide establishments which have established up a business in India have attempted to follow the very same model and also style as in their house nation.

Report this wiki page